Buying a property is a big cost. Meeting all legal and tax rules is crucial. In India, you must pay Tax Deducted at Source (TDS) on property purchases over Rs. 50 lakhs.

Here’s a detailed guide on how to pay TDS on property purchase.

Step-by-Step Guide to Pay TDS for Property Purchase

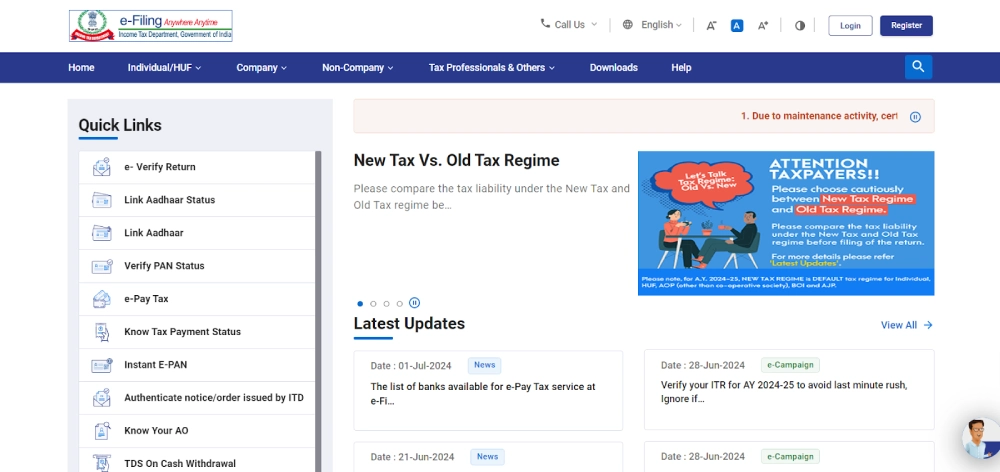

Step 1 – Open the official website of the Income Tax Department.

- Go to the Income Tax Department’s Official Website.

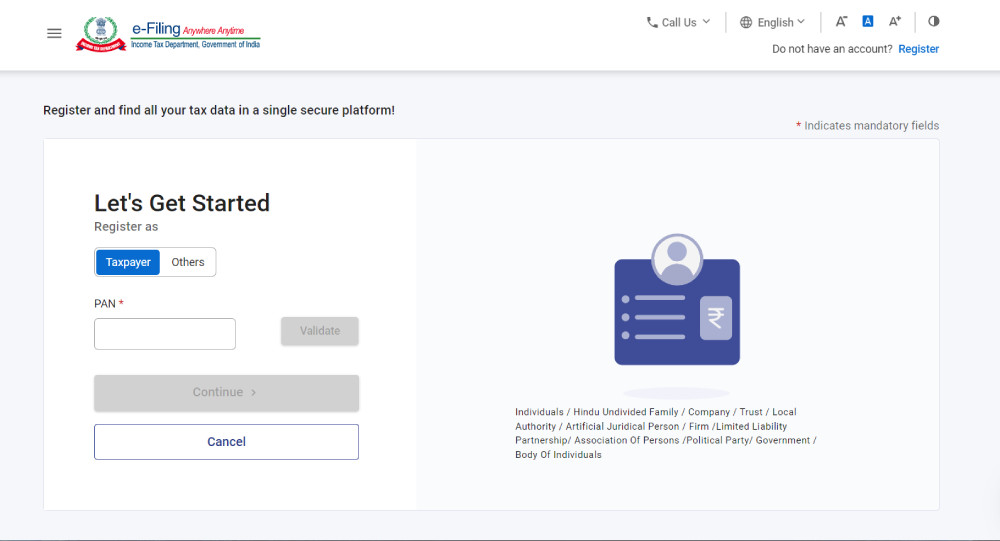

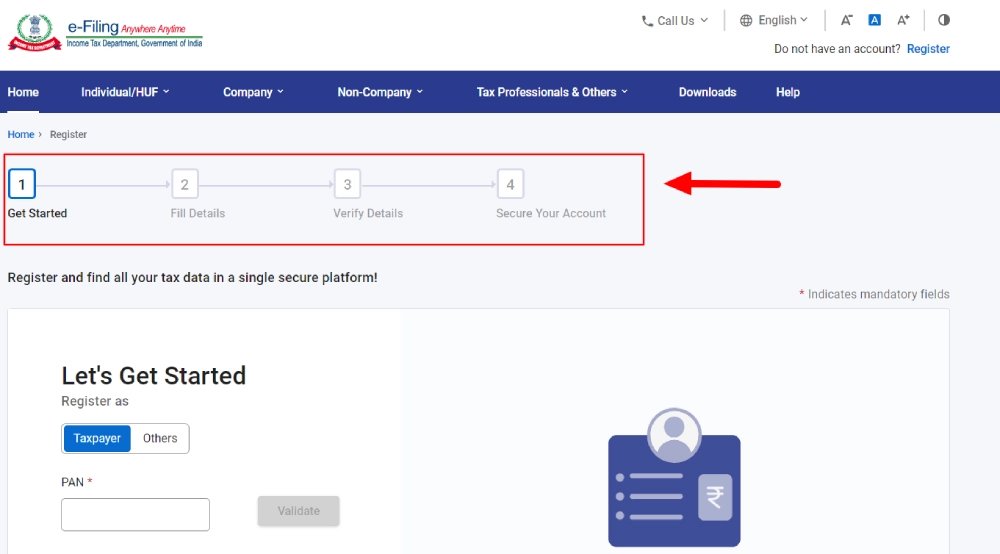

Step 2 – Register Your Account

- To sign up as a new user, you should click on the “Register” button.

- Then, you should follow the instructions to create an account. For that you will need your permanent account number(PAN). You will also need your email and mobile number for the registration.

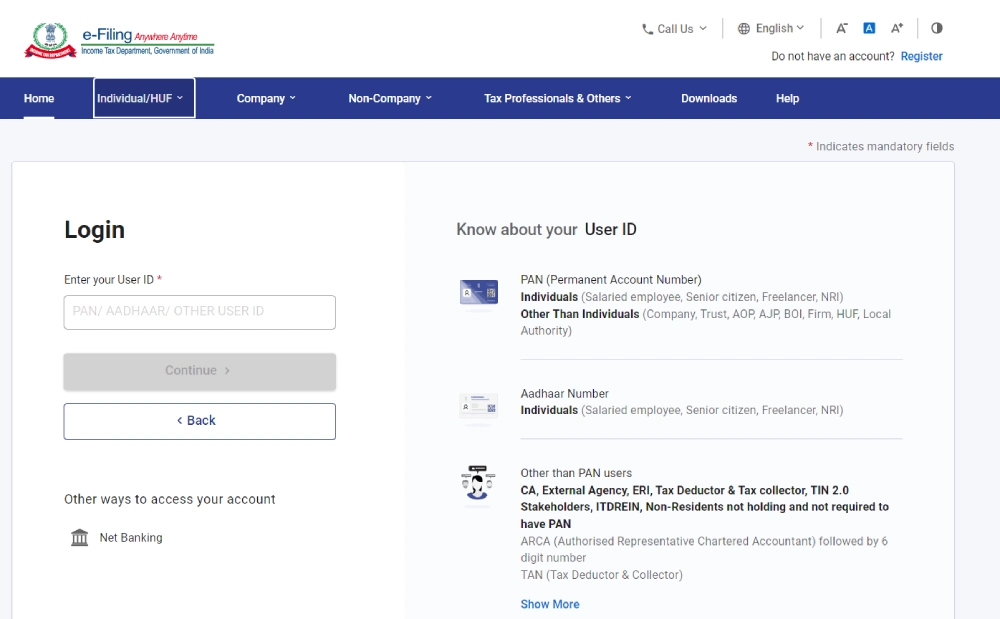

Step 3 – Login to Your Account

- Once registered, log in using your PAN, password, and the captcha code displayed on the screen.

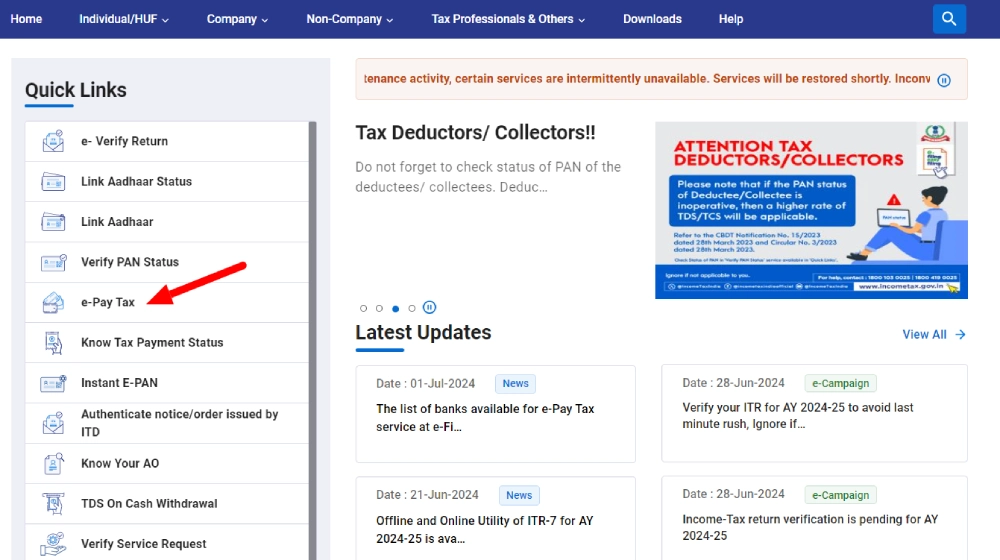

Step 4 – Select e-Pay Tax

- After logging in, navigate to the “e-Pay Tax” option available on the dashboard.

Step 5 – Select New Payment

- Click on “New Payment” to start the payment process.

Step 6 – Select TDS on the sale of property.

- In the category of payments, choose “TDS on sale of property.”

Step 7 – Fill in the buyer’s details.

- Enter the details of the buyer, such as PAN, address, and contact information. Ensure that all information is accurate and matches the records.

Step 8 – Fill in the seller’s details.

- Enter the details of the seller, including their PAN, address, and contact information.

Step 9 – Fill in the Property and Payment Details

- Provide details about the property you are buying. Include the address, type of property, and price.

- Enter the TDS amount to pay, calculated as 1% of excess property value.

- Enter the amount of TDS that you should pay. It equals 1% of the property value over Rs.50 lakhs.

Step 10 – Select payment options.

- Choose your preferred payment method, such as net banking or debit card.

- Review the details and proceed to make the payment.

Step 11 – Send us the TDS receipt.

- After you successfully make a payment, the system will generate a challan. Download and save the TDS certificate (Form 16B) from the TRACES website.

- Send the TDS receipt to the concerned parties as required.

Benefits of paying TDS online

If you wish, you also have the option to visit the nearest bank branch or tax office and make the TDS payment offline. However, the process is tedious and takes time. This is why it is suggested that you make an online TDS payment. Below are some benefits of making an online TDS payment.

Convenience

With online TDS payments, you don’t need to visit the office in person to make the payment. This option is more convenient and eliminates the need for paperwork.

Less chance for errors

Manual TDS payment might have some errors. Online TDS payment portal has built-in checks that greatly reduces the chances of errors.

Quick and efficient

Unlike offline payments, the online TDS payment procedure is simple and can be completed quickly.

Better record keeping

Online portals are better at tracking records of your payment history than offline records. You can also access these records easily increasing transparency.

Secure payments

Online payment portals are highly secure and ensure a smooth and secure payment process. It can also save your financial information from fraudulent activities.

Tax compliance: With online TDS payments, you can ensure that you make the payments on time and comply with tax laws.

Complication of not paying TDS on time

Failing to pay your TDS within the stipulated time can lead to several legal complications. Below listed are some of them.

Financial penalties

You will be charged interest for your late TDS payment. The income tax department may also impose penalties for non-compliance.

Legal consequences

In cases of severe non-compliance, you might face legal consequences like prosecution and imprisonment.

Damage to reputation

Failing to pay TDS on time can cause severe damage to your business reputation.

Tax disputes

Non-compliance with tax laws can cause inconvenient tax disputes.

Conclusion

Paying your TDS on time is a legal responsibility you must fulfill without fail. If you are into construction or are trying to sell a property, ensure you pay your taxes on time.

FAQs

Deposit TDS within 30 days from the end of the deduction month. For example, if you deduct TDS in May, deposit it by June 30th.

After you buy the property, it’s a good idea to pay the TDS promptly to avoid interest or penalties.

If you make property payments in installments, deduct TDS with each payment. Make sure to deposit it within 30 days from the end of the month when the deduction is made.